Region:Africa

Author(s):Geetanshi

Product Code:KRAA3736

Pages:93

Published On:September 2025

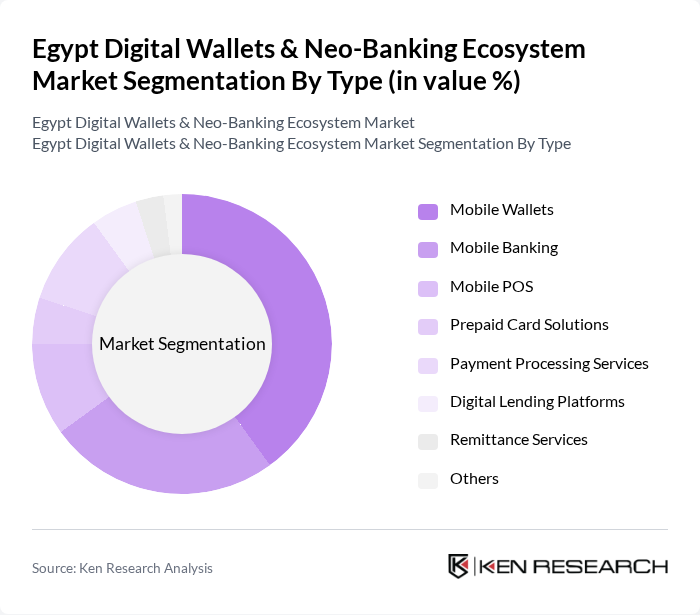

By Type:The market is segmented into various types, including Mobile Wallets, Mobile Banking, Mobile POS, Prepaid Card Solutions, Payment Processing Services, Digital Lending Platforms, Remittance Services, and Others. Among these, Mobile Wallets have emerged as the leading sub-segment, driven by their convenience, interoperability, and widespread acceptance among consumers. The increasing use of smartphones, the expansion of QR-based merchant acceptance, and the integration of government-backed payment cards such as Meeza have further propelled the adoption of mobile wallets in Egypt .

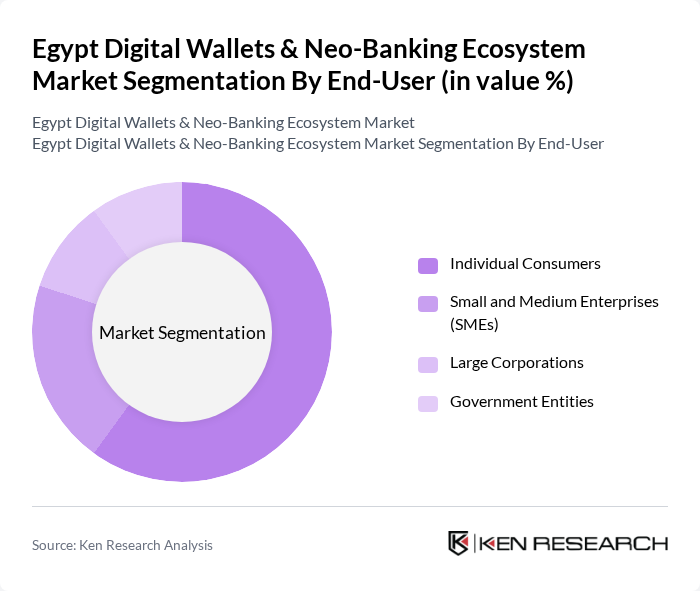

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers dominate the market, driven by the increasing adoption of digital wallets for personal transactions, peer-to-peer transfers, and online shopping. The convenience, security, and ease of use of digital wallets have made them a preferred choice for everyday transactions among consumers in Egypt, while SMEs are increasingly leveraging these solutions for merchant payments and payroll .

The Egypt Digital Wallets & Neo-Banking Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fawry for Banking and Payment Technology, EFG Hermes, Paymob, Vodafone Cash, Orange Money, CIB Egypt (Commercial International Bank), Banque Misr, National Bank of Egypt, Aman for E-Payment, Masary, NBE Digital Wallet, QNB ALAHLI, e& Money (formerly Etisalat Cash), Meeza, WE Pay (Telecom Egypt) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's digital wallets and neo-banking ecosystem appears promising, driven by technological advancements and increasing consumer demand for seamless financial services. The integration of artificial intelligence and machine learning is expected to enhance user experience and security. Additionally, the rise of open banking initiatives will foster collaboration between traditional banks and fintech companies, creating a more competitive landscape. These trends indicate a robust growth trajectory for the digital financial services sector in Egypt, enhancing accessibility and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Mobile Banking Mobile POS Prepaid Card Solutions Payment Processing Services Digital Lending Platforms Remittance Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Payment Method | QR Code Payments NFC Payments USSD/SMS Banking Bank Transfers Credit/Debit Cards Contactless Payments |

| By Service Type | Peer-to-Peer Transfers Bill Payments In-store Payments Online Purchases |

| By User Demographics | Age Groups Income Levels Urban vs Rural Users |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies |

| By Customer Support | Chat Support Phone Support Email Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 120 | Regular Users, Occasional Users |

| Neo-Banking Service Adoption | 90 | Young Professionals, Small Business Owners |

| Merchant Acceptance of Digital Payments | 60 | Retail Owners, E-commerce Managers |

| Regulatory Impact on Fintech | 40 | Regulatory Officials, Compliance Officers |

| Consumer Attitudes Towards Cashless Transactions | 100 | General Public, Financial Literacy Advocates |

The Egypt Digital Wallets & Neo-Banking Ecosystem Market is valued at approximately USD 19.6 billion, reflecting significant growth driven by the adoption of digital payment solutions and increased smartphone penetration among consumers.