Region:Africa

Author(s):Rebecca

Product Code:KRAA3330

Pages:81

Published On:September 2025

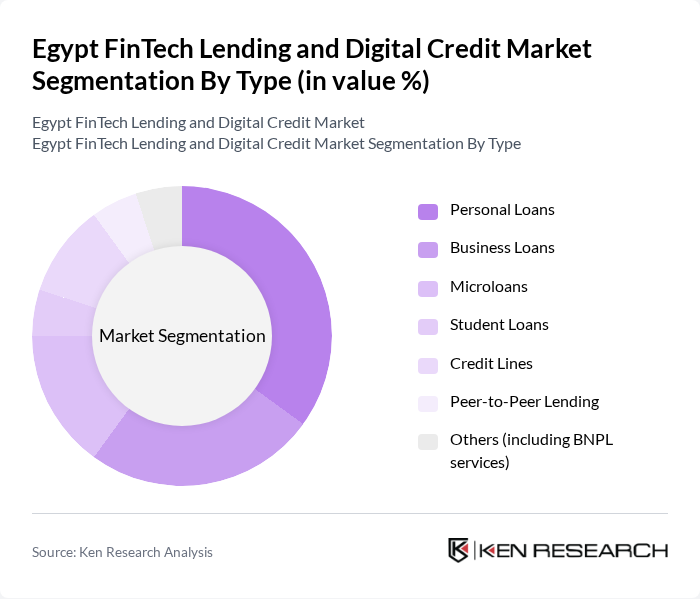

By Type:The market is segmented into various types of lending products, including personal loans, business loans, microloans, student loans, credit lines, peer-to-peer lending, and others such as Buy Now Pay Later (BNPL) services. Personal loans are currently the most popular segment, driven by consumer demand for quick and accessible financing options. Business loans are also significant, as SMEs seek funding to support growth and operations. The BNPL segment has emerged as a particularly dynamic area, with the Egyptian BNPL market reaching USD 1.26 billion and experiencing robust growth driven by rising consumer demand for installment-based payments and e-commerce platform proliferation.

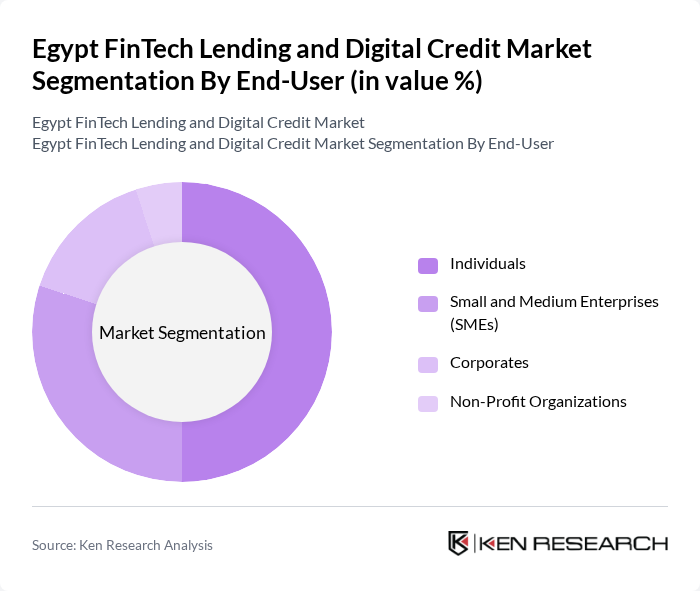

By End-User:The end-user segmentation includes individuals, small and medium enterprises (SMEs), corporates, and non-profit organizations. Individuals represent the largest segment, as many seek personal loans for various needs, including education, healthcare, and consumer goods. SMEs are also a crucial segment, as they require financing for operational costs and expansion. The individual segment has been particularly strengthened by the growth of BNPL services, with local providers like valU and Shahry focusing on affordability and accessibility for middle-income consumers across diverse needs including electronics, groceries, and essential services.

The Egypt FinTech Lending and Digital Credit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fawry for Banking and Payment Technology Services, EFG Hermes, Tamweely, Khazna, YAPILI, Paymob, NymCard, Raseedi, Qard Hasad, Blnk, Cashless, MNT-Halan, Ameen, B2B Pay, Fintech Galaxy, Dayra (Microfinance), Nice Deer (Factoring) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's FinTech lending and digital credit market appears promising, driven by technological advancements and increasing consumer acceptance. As smartphone usage continues to rise, more individuals will access digital financial services. Additionally, the integration of artificial intelligence in credit scoring will enhance lending efficiency. However, addressing regulatory challenges and improving financial literacy will be crucial for sustainable growth. The collaboration between FinTech firms and traditional banks is expected to foster innovation and broaden service offerings, ultimately benefiting consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Microloans Student Loans Credit Lines Peer-to-Peer Lending Others (including BNPL services) |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations |

| By Application | Consumer Financing Business Financing Education Financing Emergency Financing |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Retailers |

| By Customer Segment | Low-Income Borrowers Middle-Income Borrowers High-Income Borrowers |

| By Loan Size | Small Loans Medium Loans Large Loans |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Lending Usage | 120 | Individual Borrowers, Financially Active Consumers |

| SME Digital Credit Access | 80 | Business Owners, Financial Managers |

| FinTech Platform Insights | 60 | Product Managers, Marketing Directors |

| Regulatory Impact Assessment | 40 | Regulatory Officials, Compliance Officers |

| Market Trends and Consumer Behavior | 100 | Market Analysts, Economic Researchers |

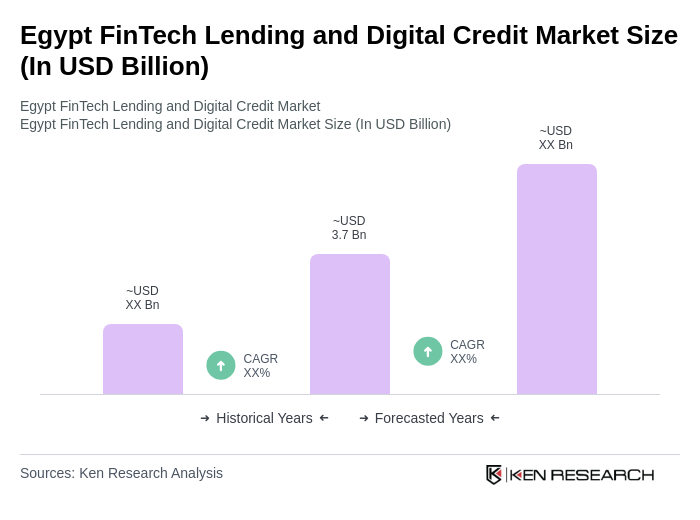

The Egypt FinTech Lending and Digital Credit Market is valued at approximately USD 3.7 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a rising unbanked population seeking accessible credit solutions.