Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3801

Pages:89

Published On:September 2025

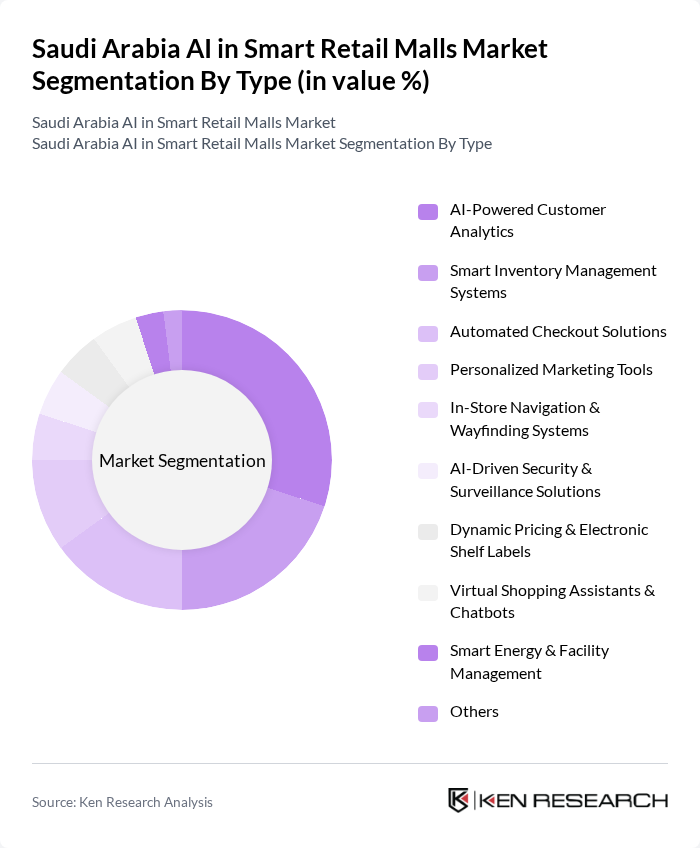

By Type:The market is segmented into various types of AI solutions that cater to different aspects of retail operations. The subsegments include AI-Powered Customer Analytics, Smart Inventory Management Systems, Automated Checkout Solutions, Personalized Marketing Tools, AI-Driven Security & Surveillance Systems, Computer Vision for Footfall & Heatmap Analytics, Dynamic Pricing & Electronic Shelf Labels, Virtual Shopping Assistants & Chatbots, and Others. Among these, AI-Powered Customer Analytics is leading the market due to its ability to provide insights into consumer behavior, enabling retailers to tailor their offerings effectively. The adoption of AI-powered analytics and automated checkout is accelerating as retailers seek to personalize experiences and optimize store operations.

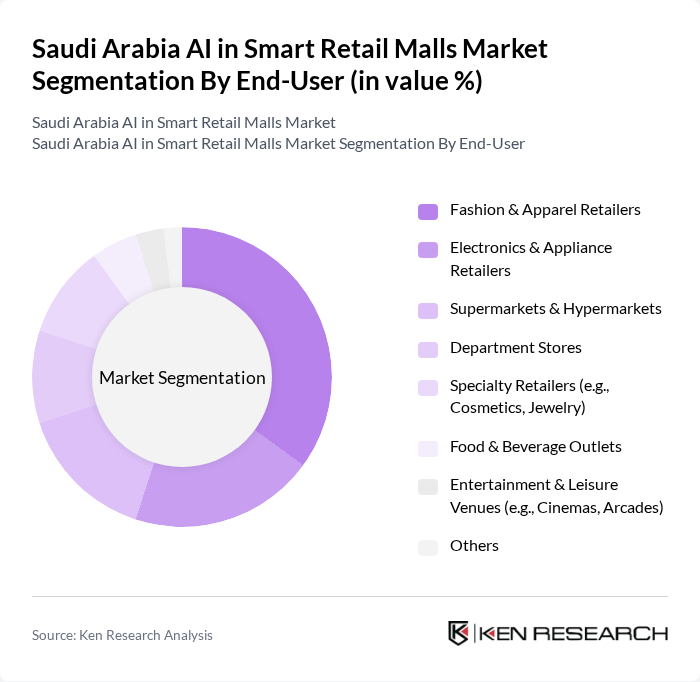

By End-User:This segmentation includes Large Retail Chains, Department Stores, Specialty Retailers, Shopping Mall Operators, E-commerce Platforms, Convenience Stores, and Others. Large Retail Chains dominate the market as they have the resources to invest in advanced AI technologies, allowing them to enhance customer experiences and optimize operations across multiple locations. These chains are at the forefront of deploying AI for hyper-personalization, predictive inventory, and seamless checkout, while mall operators and specialty retailers are increasingly adopting AI to differentiate their offerings and improve operational efficiency.

The Saudi Arabia AI in Smart Retail Malls Market is characterized by a dynamic mix of regional and international players. Leading participants such as Majid Al Futtaim, Al Othaim Holding, Emaar Properties, Al-Faisaliah Group, Jarir Marketing Company, Panda Retail Company, LuLu Group International, Carrefour (Majid Al Futtaim), Saco World, Extra Stores, Al Nahdi Medical Company, Othaim Markets, Al Jazeera Paints, Al-Muhaidib Group, Noon.com, STC Solutions, Smart Touch Technologies, SAP Saudi Arabia, Cisco Saudi Arabia, NCR Corporation Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI in smart retail malls market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As retailers increasingly adopt AI solutions, the focus will shift towards enhancing customer experiences and operational efficiencies. The integration of AI with IoT devices is expected to create smarter retail environments, while the growing emphasis on sustainability will encourage the development of eco-friendly technologies. These trends will likely reshape the retail landscape, fostering innovation and competitive advantages for early adopters.

| Segment | Sub-Segments |

|---|---|

| By Type | AI-Powered Customer Analytics Smart Inventory Management Systems Automated Checkout Solutions Personalized Marketing Tools AI-Driven Security & Surveillance Systems Computer Vision for Footfall & Heatmap Analytics Dynamic Pricing & Electronic Shelf Labels Virtual Shopping Assistants & Chatbots Others |

| By End-User | Large Retail Chains Department Stores Specialty Retailers Shopping Mall Operators E-commerce Platforms Convenience Stores Others |

| By Application | Customer Experience Enhancement (Personalization, Chatbots) Operational Efficiency Improvement (Inventory, Staffing) Sales and Marketing Optimization (Targeted Campaigns) Security and Surveillance (Fraud Detection, Loss Prevention) Data Analytics and Insights Sustainability & Energy Management Others |

| By Sales Channel | Direct Sales Online Sales Distributors and Resellers Partnerships with Technology Providers Others |

| By Distribution Mode | Online Distribution Offline Distribution Hybrid Distribution Others |

| By Price Range | Budget Solutions Mid-Range Solutions Premium Solutions Others |

| By Customer Segment | B2B Customers B2C Customers Government and Public Sector Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI Technology Providers | 60 | Product Managers, Business Development Executives |

| Retail Mall Management | 50 | Operations Managers, Marketing Directors |

| Consumer Insights | 120 | Frequent Mall Visitors, Tech-Savvy Shoppers |

| Retail Analysts | 40 | Market Researchers, Industry Consultants |

| Government Officials | 40 | Policy Makers, Economic Development Officers |

The Saudi Arabia AI in Smart Retail Malls Market is valued at approximately USD 530 million, reflecting significant growth driven by the adoption of AI technologies aimed at enhancing customer experiences and optimizing retail operations.